“Hard drives will soon be a thing of the past.”

“All-flash arrays will soon replace disks and hybrid arrays in the data center.”

“The data center of the future is all-flash.”

Welcome to the latest installment of the perennial hard drive extinction saga. The debate—with highlights sampled above—has spanned more than a decade now. The predictions foretelling hard drives’ demise, uttered by a few vocal—and shall we say, optimistic—proponents of flash-only technology, have not aged well over the years. But they seem to get increasingly brazen with time.

Without question, flash storage is well-suited to support applications that require high-performance and speed. And flash revenue is growing, as is all-flash-array (AFA) revenue. But not at the expense of hard drives. The premise underlying speculation around the death of hard drives is deeply flawed.

We are living in an era where the ubiquity of the cloud and the emergence of AI use cases have driven up the value of massive data sets. Hard drives, which today store by far the majority of the world’s exabytes (EB), are more indispensable to data center operators than ever.

Even in recent years, when flash prices temporarily dropped to all-time lows, solid state drives (SSDs) did not displace hard drives in workloads requiring mass-data storage

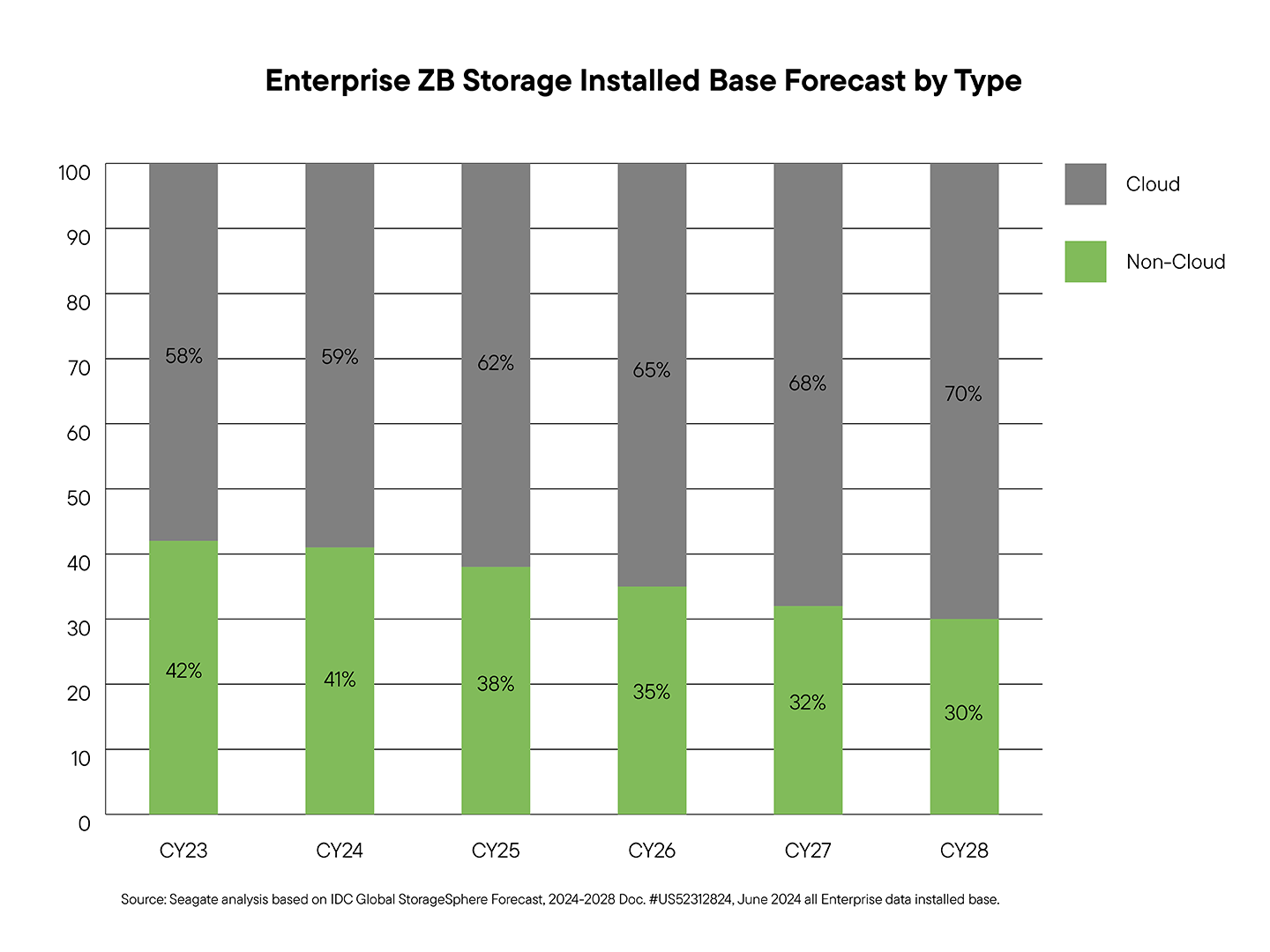

Industry analysts expect hard drives to be the primary beneficiary of continued EB growth. The chart below shows that enterprise and large-scale cloud data centers—where the vast majority of the world’s data sets reside—will be a key driver of this growth in installed capacity. According to industry forecasts, total enterprise storage is projected to grow by 8,528EB between 2023 and 2028, reaching 14ZB by 2028. Of that growth, hard drive storage is projected to grow by 440EB, SSDs by 166EB, and tape by 921EB.¹ These figures reflect absolute capacity additions across all enterprise use cases.

The chart below focuses on compound annual growth rates (CAGRs) and overall installed base by media type, rather than on these raw EB deltas. Case in point: hard drive storage is projected to grow by 440EB between 2023 and 2028, which translates to a CAGR of approximately 25% over that five-year period.² This 25% CAGR—shown in the green segment of the chart—represents growth in installed base, rising from 4.1ZB in 2023 to more than 10.5ZB by 2028. The 440EB figure refers specifically to new capacity added annually, which contributes to this overall expansion in total installed base.

It’s not a zero-sum game. In data centers, hard drives and flash have always worked in synergy, deployed in support of different services. They each have their own unique benefits and value proposition. In fact, in the era of generative AI, compute clusters closely coupled with flash technology indirectly fuel the downstream need for more hard drive EBs, since the generated content needs to be economically stored.

This storage media synergy is alive and well, while the conjecture around hard drives’ obsolescence lacks credibility and will not ultimately pan out.

Let’s take a closer look at three key myths underlying this conjecture—and the third-party data-driven reasons why hard drives will remain central to data storage architectures for the foreseeable future.

Truth #1: Pricing Disparity

Myth: SSD pricing will soon match the pricing of hard drives.

Reality: SSD and hard drive pricing will not converge at any point in the next decade.

The data is clear. Hard drives hold a firm cost-per-terabyte (TB) advantage over SSDs, which positions them as the unquestionable cornerstone of data center storage infrastructure.

Even though the NAND flash memory storage pricing remains highly volatile and hit a low in 2023 due to weak demand and oversupply, analyst firm Forward Insights had forecasted a price resurgence for SSDs starting in 2024 and through 2025, and this prediction has been borne out. After facing precipitous price declines, SSD vendors will welcome this turnaround after struggling to reduce aging inventory and cut capital expenditure to align supply with demand. Subsequently, we have already started to see price increases for NAND-based solutions.

Even as the cost per TB of both SSDs and hard drives continues to decline through at least 2027, Seagate’s analysis of research by IDC, TRENDFOCUS, and Forward Insights confirms that hard drives will remain the most cost-effective option for most enterprise tasks. The price-per-TB difference between enterprise SSDs and enterprise hard drives is projected to remain at or above a 7:1 premium through at least 2027.

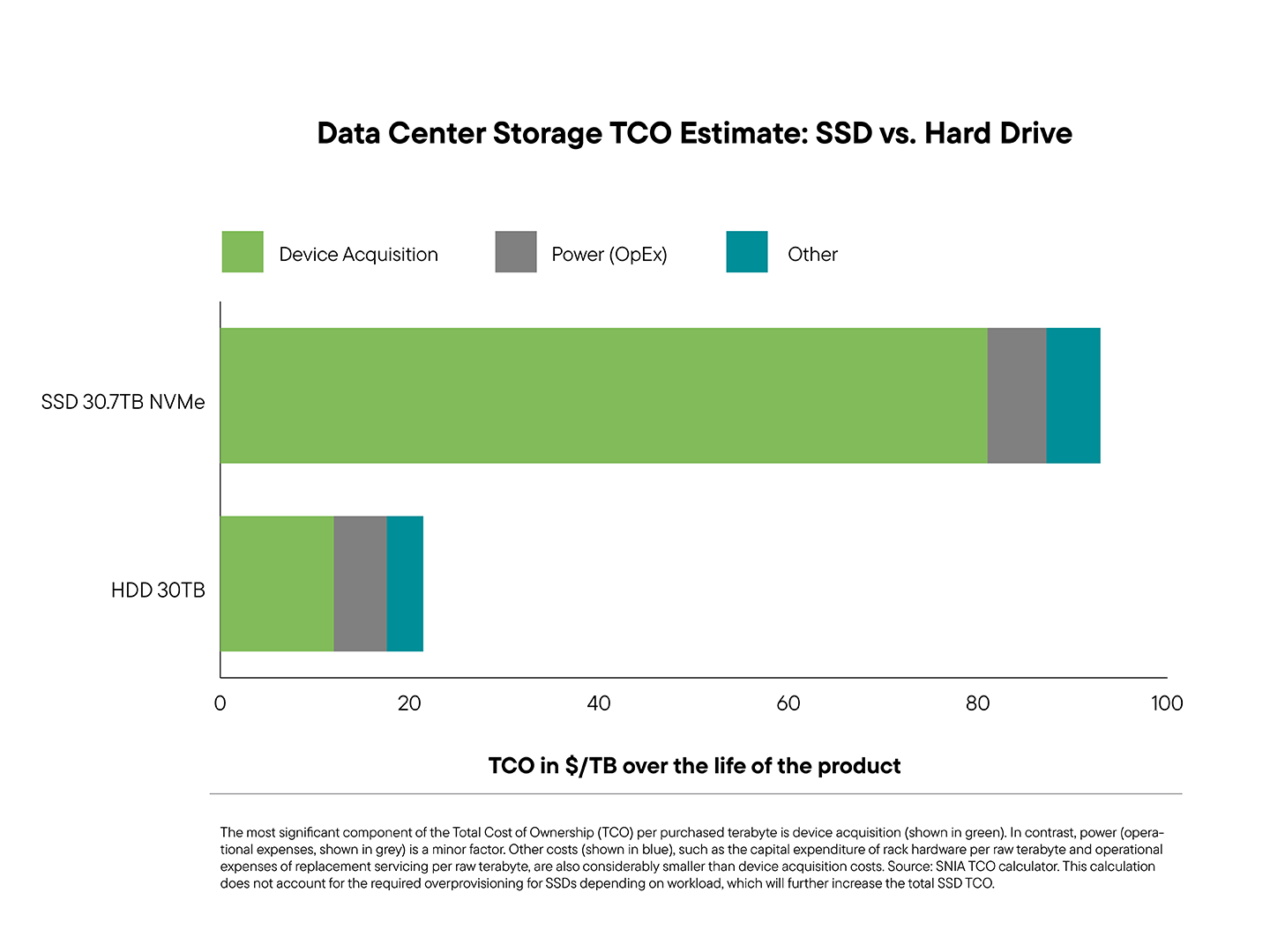

This price-per-TB differential is particularly evident in the data center, where device acquisition cost is by far the dominant component in total cost of ownership (TCO). Taking all storage system costs into consideration—including device acquisition, power, networking, and compute costs—a far superior TCO is rendered by hard drive-based systems on a per-TB basis.

To circumvent these unassailable TCO and price disparities, some AFA OEMs have begun designing their own custom high-density NAND devices with capacity points into the hundreds of TBs—claiming theoretical TCO advantages that extend beyond device economics to the system level. The problem with this logic is that adding dramatically higher levels of NAND density to a single device or system still doesn’t alter the stark cost-per-TB differential of the raw media.

Another tactic used to distract from the cost-per-TB disadvantage has to do with the so-called “TBe” or “effective terabytes.” The assertion is made that due to data reduction techniques (e.g., data compression), an SSD can offer substantially more storage space than its raw capacity implies. However, in large deployments, data reduction occurs higher up in the stack, rendering it irrelevant at the storage level. In addition, given the increased focus on protecting data and the prevalence of encryption, data compression often isn’t feasible in most enterprise and cloud use cases. When data is encrypted, it can’t be compressed because its entropy is so high that there is no pattern to simplify.

Bottom line: While flash excels at performing specific and high-performance tasks, hard drives will continue to be the primary destination for data center EBs, offering a reliable, cost-effective, and widely adopted solution for the foreseeable future.

Truth #2: Manufacturing Scale

Myth: Supply of NAND can ramp to replace all hard drive capacity.

Reality: Entirely replacing hard drives with NAND would require untenable CapEx investments.

The notion that the NAND industry would or could rapidly increase its supply to replace all hard drive capacity isn’t just optimistic—such an attempt would lead to financial ruin. Transitioning from hard drive to NAND isn’t just about producing more units. It’s a financial and logistical behemoth to execute, let alone at a price that is competitive with hard drives.

According to the Q4 2024 NAND Market Monitor report from industry analyst Yole Intelligence, the entire NAND industry shipped 3.9 ZB from 2015 to 2024, while having to invest a staggering $223 billion in CapEx—approximately 43% of their combined revenue.

In contrast, the hard drive industry addresses the vast majority—about 87%—of data center storage needs in a highly capital-efficient manner. To help crystalize this, let’s use Seagate Technology as a proxy for the hard drive industry. Between 2015 and 2024, Seagate shipped 4ZB of storage. Seagate’s capital investments over that nine-year period totaled $4.5 billion, or only around 4.9% of Seagate’s total hard drive revenue. This equals approximately $57 billion per ZB for the NAND industry versus about $1.1 billion per ZB for hard drive production (as represented by Seagate). The hard drive industry is far more efficient at delivering ZBs to the data center. Seagate’s analysis of forecasts from IDC for hard drives and Forward Insights for SSDs shows that in 2025, hard drive EB production will be almost 2.5 times that of SSDs. In that same year, in enterprise and data center markets, hard drive EB production will be four times that of SSDs.

Looking across enterprise-grade storage devices, hard drives remain unmatched in cost efficiency, scalability, and sustainability. Compared to SSDs and DRAM, hard drives deliver the lowest cost per gigabyte, ship the largest volume of exabytes, and require the lowest CapEx intensity as a percentage of revenue. They also offer the lowest embodied carbon footprint per TB, reinforcing their role as the most efficient and sustainable storage choice at scale.

See the comparison below across three key dimensions—cost, scale, and efficiency—averaged from CY2020 to CY2024. The hard drive industry is far more efficient at delivering ZBs to the data center.

Recently, some AFA vendors have claimed that the flash industry could fully replace the entire hard drive industry’s capacity output by 2028. Let’s look at what kind of investment would be needed by the NAND industry to achieve this.

According to Seagate internal estimates, NAND suppliers would need to invest roughly $240 billion in additional CapEx to replace future enterprise hard drive demand—whereas hard drives themselves can meet that demand with an investment of only about $1 billion. The math speaks for itself. Hard drives continue to offer a radically more capital-efficient path to scale.

The chart below shows enterprise EB demand in 2024 and 2028, and the investment gap between hard drives and NAND technologies needed to meet it.

It’s clear that an investment of this scale—roughly $240 billion—is unlikely for an industry facing uncertain returns, especially after losing money throughout 2023.

The latest NAND Flash Platinum Datasheet from TrendForce shows there are about 28 operating NAND fabrication plants (fabs) worldwide, as of 2024. If we use Kioxia’s Fab7 Phase 1 (opened in October 2022) as an example, building a single green-field NAND fab costs about $6.8 billion. Thus, the $240 billion incremental CapEx needed by the NAND industry would roughly equal 35 new fabs. This investment is dedicated primarily to enterprise data center applications.

While the $240 billion in additional CapEx is required just to match future enterprise hard drive capacity, it's important to note that NAND fabrication plants serve far more than the enterprise SSD market. According to Yole Intelligence’s Q4 2024 NAND Market Monitor, the industry is projected to invest over $74 billion to produce 1.1 ZB of total NAND output across all markets.

When accounting for this broader production demand—including phones, tablets, and other devices—total NAND investment needs will balloon to an estimated $414 billion, or roughly 50 new fabs. That is more than 15 times the projected 2028 revenue of the entire hard drive industry—estimated at approximately $22 billion, according to IDC3. This highlights a key contrast: hard drive manufacturing is almost entirely focused on enterprise-scale storage, while NAND fabs must serve many markets, spreading investment across fragmented and non-interchangeable use cases.

These facilities would need to be built, scaled, tested, qualified, and brought online to full production in the next three to four years, more than doubling the number of NAND fabs worldwide in less than four years.

Additionally, IDC’s 2024 StorageSphere report4 shows that in 2024, the ratio of existing hard drive to SSD installed capacity in cloud and non-cloud data centers was 7:1. IDC forecasts this dominant hard drive-based EBs ratio to stay around six to seven times for the foreseeable future, with a 21% CAGR, leading to an installed hard drive capacity of as much as 10.5ZB in 2028. Therefore, besides replacing all future annual production of new hard drive installations year by year as previously described, the NAND industry would also need to invest to replace the aging portion of this 10.5ZB installed base of data center hard drives when they reach the end of their life cycles—an incremental investment well above the $414 billion needed just to replace the 2.4ZB hard drive capacity expected to be delivered in 2028 for enterprises.

NAND solutions serve specific data center workloads efficiently, but the idea that data centers will fully rely on them is littered with pitfalls. Beyond the risks and the implausibility of the NAND industry replacing the hard drive supply, volatile pricing adds another layer of uncertainty for businesses seeking supply stability and the best TCO for their storage.

The idea that NAND could completely replace hard drives in the foreseeable future is highly improbable, if not impossible. The industry would have to overcome formidable financial and logistical obstacles while investing a large amount of capital and technology in a market that isn’t prepared for a change that would upend current data center architecture.

Truth #3: Workload Profiles

Myth: Only AFAs can meet the performance requirements of modern enterprise workloads.

Reality: Enterprise storage architecture usually mixes media types, using disk or hybrid arrays, flash, and tape to optimize for the cost, capacity, and performance needs of specific workloads.

At issue here is a false dichotomy. All-flash vendors advise enterprises to “simplify” and “future-proof” by going all-in on flash for high performance. Otherwise, they posit, enterprises risk finding themselves unable to keep pace with the performance demands of modern workloads. This zero-sum logic fails for three reasons:

- The vast majority of modern workloads do not require the performance advantage offered by flash.

- Enterprises under budget constraints and with rapidly growing data sets must balance capacity and cost, as well as performance.

- The purported simplicity of a single tier storage architecture is a solution in search of a problem.

Let’s address these one by one.

First, most of the world’s data resides in the cloud and large data centers. In these environments, workloads follow a Pareto rule: only a small percentage of the workload requires a significant percentage of the performance. Hyperscaler deployment trends are a leading indicator of storage architecture at scale. According to IDC⁵, from 2019 to 2023, hard drives accounted for about 87% of exabytes shipped to cloud service providers and hyperscale data centers.

Most of the world’s data is part of workloads that need nominal data transfer time for general-purpose use cases. Take a look at the chart below, derived from IDC’s Cloud Infrastructure Index 2025 research.

In some cases, all-flash systems are not even required at all as part of the highest performance solutions. There are hybrid storage systems that perform as well as or faster than all-flash drives. At a device level, the differences in performance are obvious; however, at scale in data center racks, hard drive performance benefits from extremely parallel access, resulting in a performance level that is more than sufficient for most workloads, including AI and machine learning. Just as important, any significantly incremental performance advantages afforded by flash can often be constrained by other infrastructure decisions, like network capacity or quality.

Second, as established earlier in this article, TCO considerations are key to most data center infrastructure decisions. This forces a balance of cost, capacity, and performance. Optimal TCO is achieved by aligning the most cost-effective media—hard drive, flash, or tape—to the workload requirement. Hard drives and hybrid arrays (built from hard drives and SSDs) are a great fit for most enterprise and cloud storage and application use cases.

Of course, one might elect to use SSDs or AFAs for workloads that are best suited for hard drives—like file services, object storage, document management systems, or web hosting. But cost-wise, the higher the capacity, the more strangely illogical such a decision would be. It’s like using your car, parked in a garage, to store your clothes. Doable? Sure, if that’s what you want to do with a car. But cost-effective? Not at all.

While flash storage excels in read-intensive scenarios, its endurance diminishes with increased write activity. Manufacturers address this with error correction and overprovisioning—extra, unseen storage, to replace worn cells. However, these solutions come with extra costs: Overprovisioning greatly increases the imbedded product cost, and constant power is needed to avoid data loss. This poses challenges for environments like edge data centers, or any setting where continuous operation isn’t guaranteed and is accelerated at high temperatures and throughput.

Additionally, while technologies like triple level cell (TLC) and quad-level cell (QLC) allow flash to handle data-heavy workloads like hard drives, the economic rationale weakens for larger data sets or long-term retention. In these cases, disk drives, with their growing areal density, offer a more cost-effective solution. In hyperscale environments, leveraging thousands of hard drives in parallel achieves performance that complements flash, illustrating their collaborative role in modern data centers.

Consequently, while QLC flash is taking over a sizable percentage of the TLC market—much like how TLC replaced multi-level cell (MLC) NAND storage—it is not eroding hard drive market share due to cost, availability, and workload factors explored in this article.

The third and related point is the claim that AFAs are superior to hybrid arrays or hard drive storage systems. Flash proponents claim that using one type of storage is “simpler” than adopting a mix of media types and storage tiers. Not so fast.

Many hybrid storage systems employ a well-proven and finely tuned software-defined architecture that seamlessly integrates and harnesses the strengths of diverse media types into singular units. In scale-out private or public cloud data center architectures, file systems or software defined storage is used to manage the data storage workloads across data center locations and regions. They offer more than adequate flexibility, allowing businesses to adjust their storage composition based on ever-changing needs.

AFAs and SSDs are a great fit for high-performance, read-intensive workloads. But it’s a mistake to extrapolate from niche use cases or small-scale deployments to the mass market and hyperscale where AFAs provide an unnecessarily expensive way to do what hard drives already deliver at a much lower TCO.

Cloud, hyperscale, and large enterprise storage architectures select storage that optimize cost, capacity, and performance. Hard drives serve workloads that flash drives should not. Flash serves workloads that hard drives should not. Both storage media will coexist in the data center, with hard drives continuing to dominate in terms of EBs stored for the foreseeable future.

Speaking of EBs, it’s common to point to increasing SSD unit volumes in conjunction with declining hard drive unit shipments as proof of a turning point in the storage market. But this argument is a red herring, failing to recognize step-ups in hard drive capacity and total hard drive EB shipments, which are trending up faster than ever. Case in point: thanks to HAMR-enabled areal density innovation, Seagate’s new Mozaic™ platform will double maximum unit capacity over the next four years, whereas traditional perpendicular magnetic recording (PMR) technology took nine years to achieve the doubling of capacity.

Instead of counting unit volume, what matters when it comes to accurately measuring growth are EB shipments. Analysts predict hard drive EB shipments will continue increasing at an unprecedented rate. And although flash storage will also see growth, it won’t approach hard drives in terms of installed capacity.

Seagate analysis of data from IDC and TRENDFOCUS predicts a doubling of the increase in EB outlook for hard drives by 2028. Extrapolating further out in time, that ratio holds well into the next decade.

While SSD output is also increasing, it’s important to look at what kind of SSDs are being produced. As the chart below shows, the gap between total SSD shipments and enterprise SSD shipments is widening. That means a growing share of NAND output is being directed toward consumer and non-enterprise segments—mobile, embedded, edge—not enterprise-class SSDs. For customers relying on enterprise flash, this may translate to persistent supply constraints, even as total SSD production grows. The investment mix simply isn’t indexing toward the types of SSDs most needed in the data center.

Here to Stay

The supposed obsolescence of hard drives has been a topic of discussion in the technology industry for more than a decade. But the various predictions have not aged well. We do not expect the most recent round to pan out either.

Almost invariably, all-flash absolutists attempt to substantiate their arguments with logical fallacies, often extrapolating from a small subset of use cases to scale—which is where their conclusions don’t hold.

It’s creative marketing at best.

In reality:

- NAND and hard drive pricing will not converge anytime soon, especially with accelerated hard drive areal density gains afforded by the volume ramp of Seagate Mozaic 3+ platform.

- Contrary to what some have suggested, NAND producers will not be able to scale manufacturing capacity to replace the existing and new hard drive EB demand. It is impossible for AFA vendors to offer both enough supply and cheaper storage than hard drives because of the level of investment required. The AFA manufacturers are unlikely to find hundreds of billions of dollars to invest at a 15:1 loss to create enough NAND to replace hard drives.

- Large cloud and enterprise data center operators are pragmatic and understand that scale-out storage architectures require a mix of media—optimized to meet the budget, capacity, and performance needs of their workloads.

Of course, there are other myths that contribute to the “creative marketing” that predicts the demise of hard drives—myths around sustainability, power, reliability, among other areas. Stay tuned: we will address them in coming posts. However, the three myths discussed above strike us as the most relevant.

Any serious interrogation of the data laid out in this article leads to the conclusion that hard drives are here to stay. They will continue to store the vast majority of the world’s data far into the future.

To suggest otherwise is pure delusion.